How to get consent in 6 to 8 weeks

Our unique approach to the consenting process gets a quick, successful outcome – every time. Learn how with our free guide.

- All

- ! Без рубрики

- 1) 1100 links English Frt trigger DONE

- 1) 1100 links Mix Casino (1-DK) (DONE)

- 1) 2000 links Thailand เว็บซื้อหวย (DONE)

- 1) 375 links Thailand บาคาร่า DONE

- 1) 550 links France Casino (DONE)

- 1500Z

- 150gimnasium.ru

- 2) 2600 links Mix Casino (10-Spain_es-es) DONE

- 2) 2600 links Mix Casino (8-Peru_es-pe) DONE

- 2) 550 links UK Casino (DONE)

- 2000allZ

- 2000Z

- 2000ZDP

- 2000ZDP

- 3) 1100 links Sweden Casino DONE

- 3) 1750 links Netherlands Mix (1-2-NL) (DONE)

- 3000Z

- 3000Z

- 3000Z

- 6000allZ

- 750Z

- a16z generative ai

- adobe generative ai 1

- adobe generative ai 3

- adorans.hu

- alaska54.ru

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ

- allZ — копия

- allZ — копия (2)

- ami-pizza

- antsaat.com

- APK

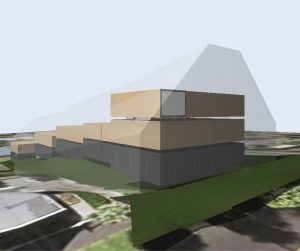

- Architecture

- ard-pro.ru

- bahis

- bahistasal nov 6028

- bezdep-s-vyvodom.site 1000

- blog

- bobrovs.ru

- bor-neked.hu1660Z

- bt_weareautoworld.com

- Business, Customer Service

- butorgaleria.hu1660Z

- casino

- cctvstore.ru

- chuchotezvous.ru

- Consenting

- detsad20-rzn.ru

- docs

- doy-ckazka.ru 1000

- edisonperets.ru

- Food & Beverage, Gourmet

- Forex News

- fortune-rabbit-demo-online.com 500

- Health & Fitness, Acne

- Health & Fitness, Exercise

- ikranalchik.ru

- intellectplanet.ru 2

- Internet Business, Ecommerce

- jan_hbgstampede

- jan4

- jumpingwear.ru

- kazino-bezdepozita.store 1000

- khelibet

- koncert-2024.rucasino 1000

- lotohelp.ru

- mds-online.ru 200

- medklinika-garmoniya29.ru

- museum-williams.ru

- myrajasthanclub.com

- names for ai robots 1

- NEW

- news

- nobilia-kitchen.ru 2000

- ocm.ru

- online-winx-games.ru

- Planning

- polar-krm.ru

- Politics, Commentary

- Post

- Product Reviews, Consumer Electronics

- Project Management

- radiodetal54.ru

- Recreation & Sports, Fishing

- redfoods.ru

- Reference & Education, College

- robot-santehnika.ru

- roktojog.org

- royandaspb.ru

- showbet 8400

- Society, Relationships

- statura.ru

- sun-rest.ru

- t.meHaiGHRollerEMpire_2026 1500

- t.meKaSSiNo_FriSpiny_HyPe2026 1500

- t.mepokerdom_ofitsialnii_sait_igrat 1500

- t.mepokerdom_ofitsialnii_sait_zerkal 1500

- t.mepokerdom_skachat_android2026 1500

- t.mepokerdom_zerkalo_rabochee_na_seg 1500

- t.mepokerdom_zerkalo_saita 1500

- t.mepokerdom_zerkalo_skachat 1500

- t.meriobet_promokod2 1500

- t.mesKaSSiNo_FriSpiny_HyPe2026

- t.mespokerdom_ofitsialnii_sait_zerkal

- tcmk24.ru 1

- tcmk24.ru 2000

- test

- Travel & Leisure, Outdoors

- tunaanaokulu.com

- tvoyvibor-63.ru

- ugraloppet.ru

- uncategorized

- Unitary Plan

- unworld.ru

- valutakurs.ru

- Vehicles, Cars

- willwax.ruall 1

- world-vision.ru

- zenit-24.ru

- Пости

Similar Advice

A Perfect Storm for Auckland Developers

Why you need to take advantage of the new LVR requirements and buyer’s market now At the end of last…

Why you need to take advantage of the new LVR requirements and buyer’s market now At the end of last year, the Reserve Bank made some alterations to the loan to value ratios (LVR) that banks typically use when lending for mortgages. The new LVR restrictions have been loosened enabling developers to borrow 65% of a property’s value (up from 60%). …

What Impact Will a Labour Government Have on the Auckland Property Market?

This video looks at the impact the change in political…

The Real Solution to the Affordable Housing Crisis Facing Auckland

The answer lies in freeing up land by offering better living solutions for Baby Boomers There seems to be a…

The answer lies in freeing up land by offering better living solutions for Baby Boomers There seems to be a misconception about how we achieve affordable housing in Auckland. This being that you simply find a bit of land, limit construction costs as much as possible and in doing so, you’ll get the magical sales number of $550,000 to $650,000.…